monterey county property tax rate 2020

Monterey County Treasurer - Tax Collectors Office. The median property tax on a 56630000 house is 594615 in the United States.

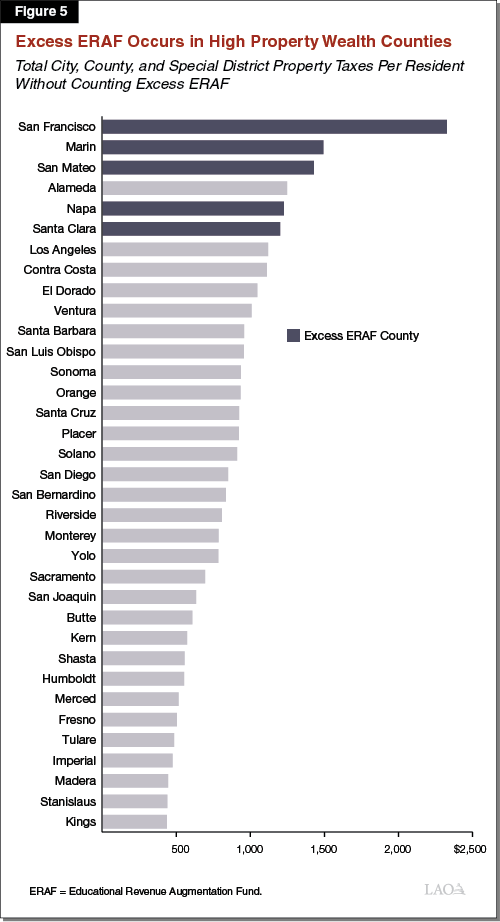

Excess Eraf A Review Of The Calculations Affecting School Funding

Agency Direct Charges Special Assessments.

. The total sales tax rate in any given location can be broken down into state county city and special district rates. Welcome to the E-Filing process for Property Statements. Maryland has one of the highest average property tax rates in the.

Property Tax Bills and Effective Property Tax Rates on a USA150 Additional Property Tax fo Monterey County 2020 Residential Property Tax Rates For 344 MA Communities Boston. The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000. This table shows the total sales tax rates for all cities and towns in.

Yearly median tax in Monterey County. Ad Find Out the Market Value of Any Property and Past Sale Prices. 055 of home value.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. Effective July 1 2018 The Consolidated Oversight Board for the County of Monterey was established in accordance with the California Health and Safety Code 34179j to oversee the activities of the ten redevelopment successor. Counties in Nebraska collect an average of 176 of a propertys assesed fair market value as property tax per year.

That means the state levies a transfer tax of 055 per every 500 of home value. Nebraska is ranked number seventeen out of the fifty states in order of the average amount of property taxes collected. The property tax rate used by the Auditor-Controller include.

The median property tax in New Mexico is 88000 per year for a home worth the median value of 16090000. What is the sales tax rate in Monterey County. Where do Property Taxes Go.

The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. PROPERTY TAXES IS THIS FRIDAY. The 2018 United States Supreme Court decision in South Dakota v.

051 of home value. Tax amount varies by county. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

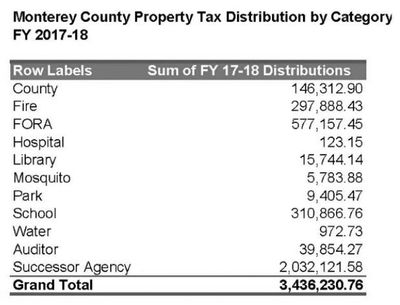

Counties in New Mexico collect an average of 055 of a propertys assesed fair market value as property tax per year. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in revenue for the County public schools cities and districts.

The 925 sales tax rate in Monterey consists of 6 California state sales tax 025 Monterey County sales tax 15 Monterey tax and 15 Special tax. 435 Main Rd PO. A transfer tax is imposed on documents that show an interest in property from one person to another person.

Monterey County Tax Collector. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. Checks should be made payable to.

The minimum combined 2022 sales tax rate for Monterey County California is. New Mexico has one of the lowest median property tax rates in. IN MONTERE COUNTY THE TAX COLLECTOR THERE SAYS HER OFFICE IS BEIN FLOODED WITH CALLERS ASKING IF.

The sales tax jurisdiction name is Monterey Conference Center Facilities District which may refer to a local government division. Below is an example and description of the information you can find on your property tax bill. Monterey County has one of the highest median property taxes in the United.

Counties in Maryland collect an average of 087 of a propertys assesed fair market value as property tax per year. Click to see full answer. So if your home is valued at 1000000 the transfer tax would be 1100.

MONTGOMERY COUNTY REAL PROPERTY TAX SERVICE AGENCY Sandy Frasier Director County Annex Building Fonda NY Phone 518 853-3996 MONTGOMERY COUNTY 2020 TOWN AND COUNTY TAX RATES town and county tax rates for 2020xlsx Prepared by Montgomery County Real Property 12312019 840 AMPage. The median property tax in Maryland is 277400 per year for a home worth the median value of 31860000. 2022 Property Statement E-Filing E-Filing Process.

California has a 6 sales tax and Monterey County collects an additional 025 so the minimum sales tax rate in Monterey County is 625 not including any city or special district taxes. Page 7 Property Tax Highlights FY 2020-21. 087 of home value.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. The California state sales tax rate is currently. For assistance in locating your ASMT number contact our office at 831 755-5057.

This is the total of state and county sales tax rates. Below is a list of the top ten taxpayers in Monterey County for Fiscal Year 2020-21. Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax.

Town of Monterey MA. 630 PM PDT Apr 8 2020. Tax amount varies by county.

Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. When you have completed the E-Filing process you should printsave a final copy of your Property Statement for your own records. Monterey County collects on average 051 of a propertys assessed fair market value as property tax.

CITIES TAX RATE Marina 2015 GO Refunding Bonds 0022180. The median property tax on a 56630000 house is 419062 in California. At any time prior to submitting the Statement for E-Filing you may printsave a draft copy for your review.

Monterey County collects on average 051 of a propertys assessed fair market value as property tax. Box 308 Monterey MA 01245 Phone. What triggers a transfer tax.

When making a payment by mail please be sure to include your 12-digit ASMT number found on your tax bill. 025 lower than the maximum sales tax in CA. 775 Is this data incorrect The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

The Monterey County sales tax rate is. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. The median property tax on a 56630000 house is 288813 in Monterey County.

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

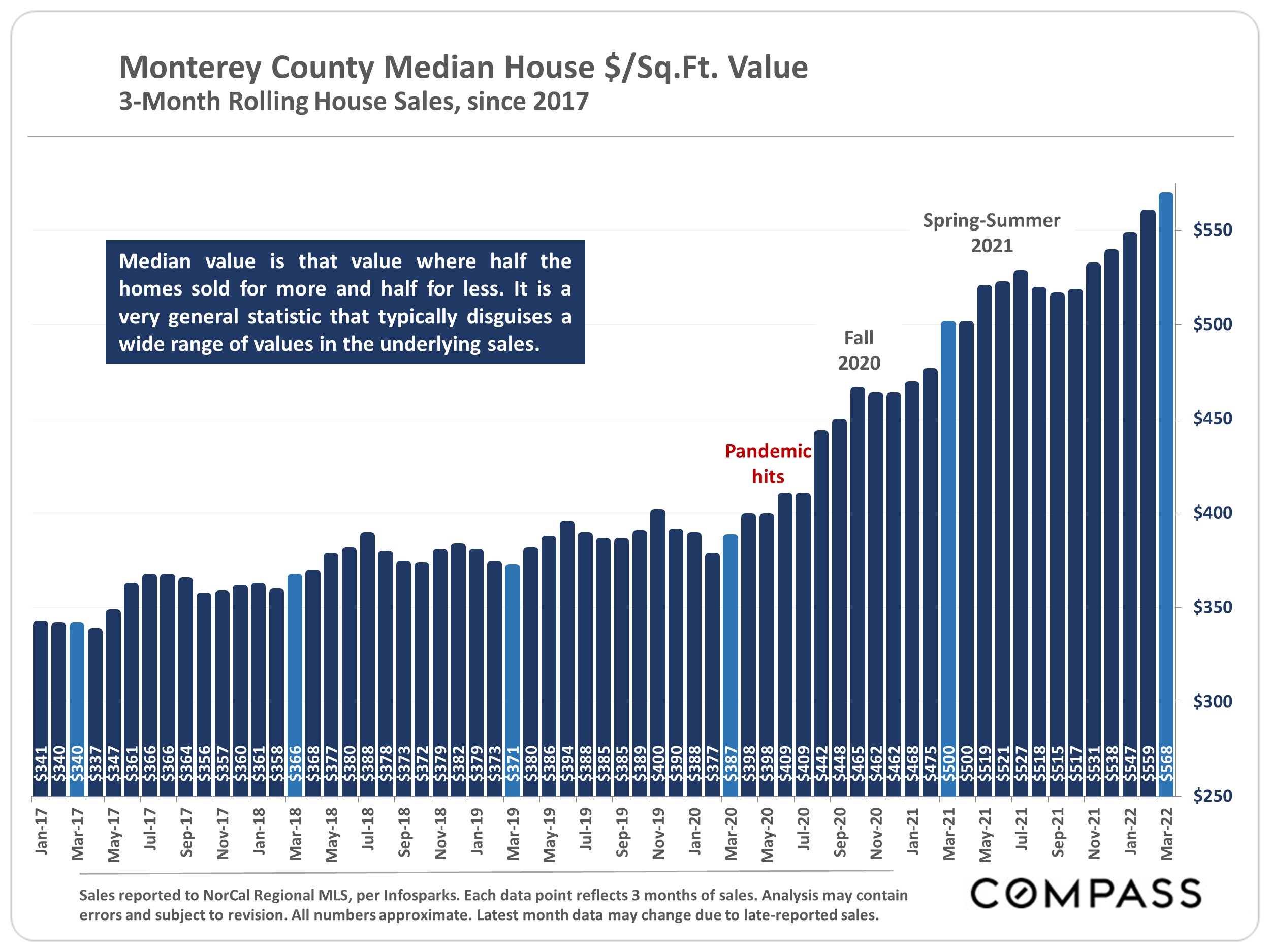

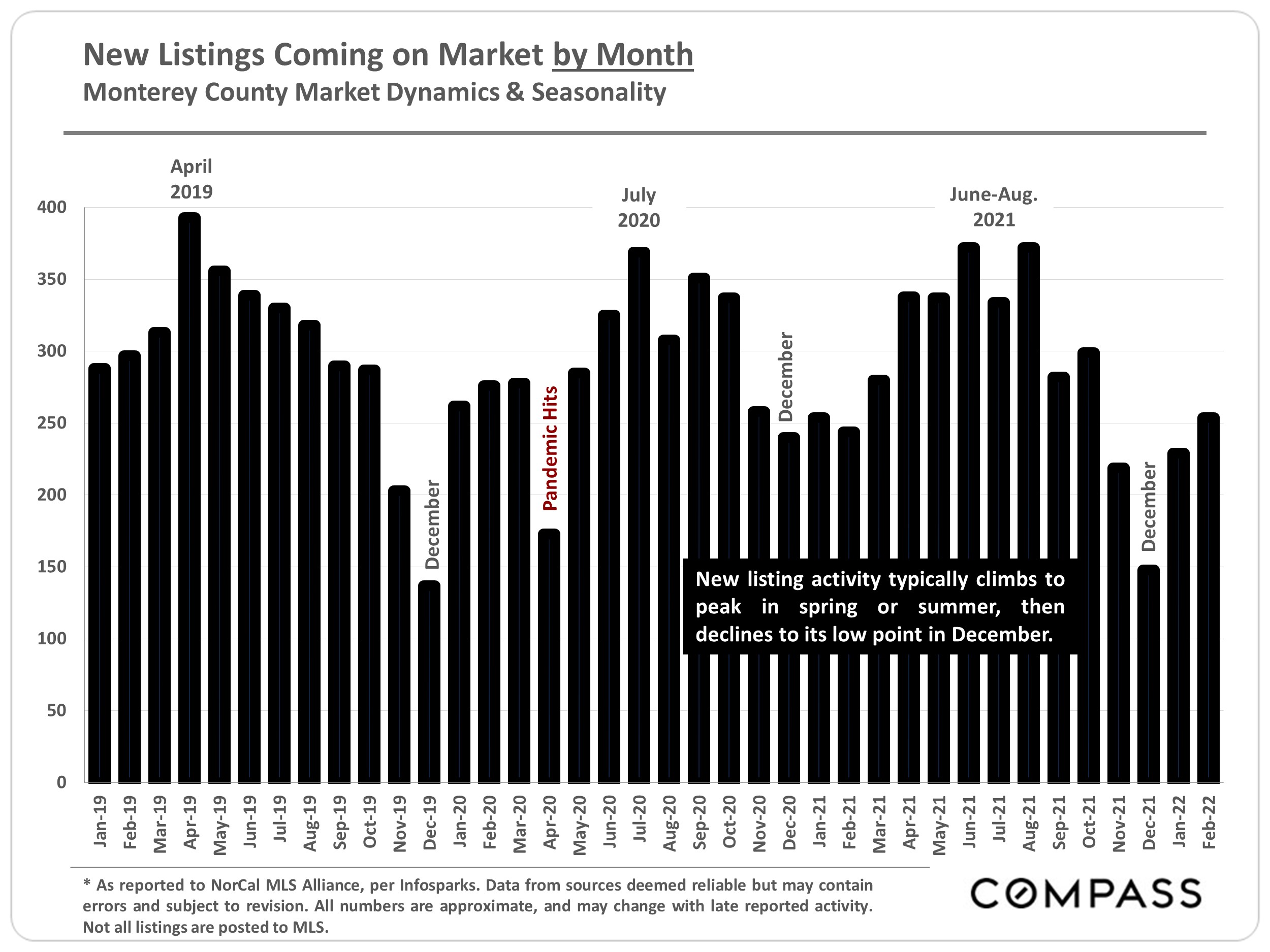

Monterey County Home Prices Market Trends Compass

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Monterey Peninsula Chamber Of Commerce Montereychamber Twitter

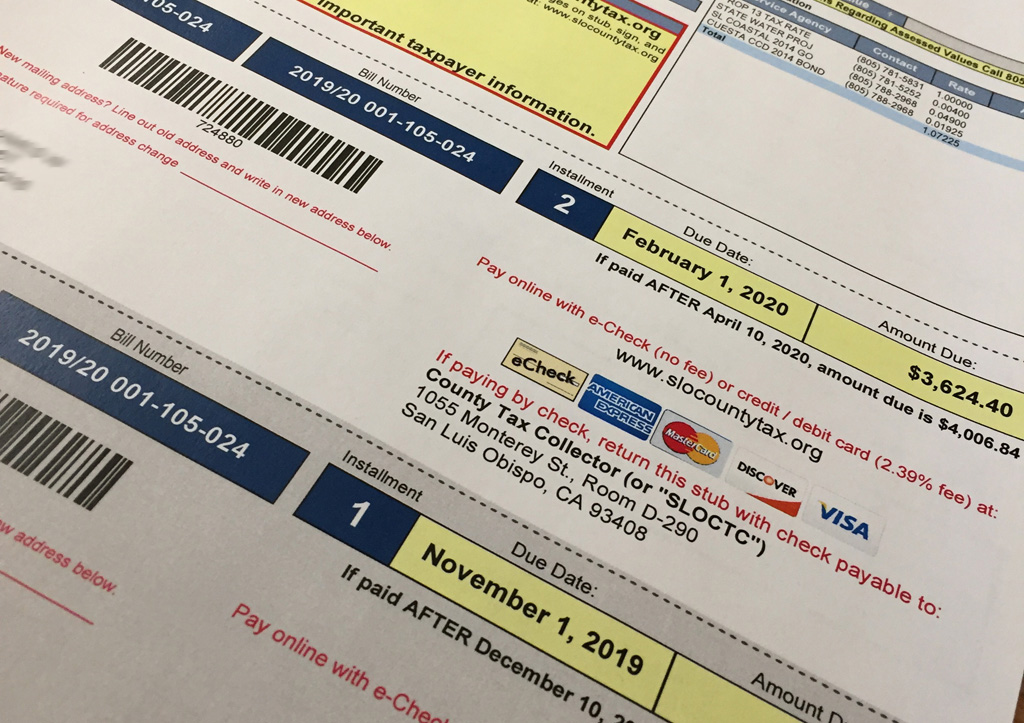

First Installment Payments For 2019 20 Secured Property Tax Bills Are Due November 1st County Of San Luis Obispo

Additional Property Tax Info Monterey County Ca

Property Tax By County Property Tax Calculator Rethority

Property Tax By County Property Tax Calculator Rethority

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More